Committee suggests inflation-linked user charges, broader tax base, and efficient asset monetization.

BENGALURU

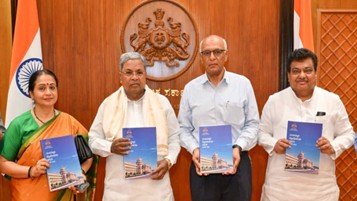

The Resource Mobilization Committee (RMC) has, in its final report, recommended rationalizing user charges in public services and establishing a mechanism to automatically revise these charges in line with inflation. The committee, formed in August 2024 to strengthen Karnataka’s fiscal position and promote sustainable economic growth, submitted its comprehensive report to Chief Minister Siddaramaiah.

The report proposes a phased transition to a volumetric billing system, wherein charges are levied based on the extent of service usage. It also recommends creating a formula-based framework that allows for automatic inflation adjustments, ensuring the financial sustainability of public services.

To reduce the state’s dependence on a few key revenue sources, the RMC has suggested tax reforms, including expansion of the tax base and better compliance mechanisms. For the Excise Department, it recommends introducing auction-based digital certificates to enhance transparency and efficiency.

The committee has also proposed several measures to tap into non-tax revenue potential—such as scientific asset valuation, expanding leases through public-private partnerships (PPPs), and monetizing urban land assets. Additionally, it advises establishing an Economic Policy Division within the Finance Department to enhance policy capacity, track non-tax revenue, and oversee asset monetization.

Karnataka, the report notes, continues to outperform many states in terms of economic growth. Own-tax revenue contributes between 60% and 70% of the state’s total receipts, with commercial tax, excise, registration and stamp duty, and motor vehicle tax forming the major components. However, non-tax revenues remain low, signaling untapped opportunities in user fees, leasing, and government asset monetization.

The committee emphasized the importance of systematic property surveys and comprehensive data management to improve the valuation and utilization of state-owned assets. It also suggested that local bodies explore new revenue avenues through revision of guideline values and property taxes, which could significantly enhance municipal fiscal capacity.

BOX:

The committee’s report highlighted the need to allocate adequate funds to growth-promoting sectors such as infrastructure, education, and health, while ensuring prudent expenditure management. It also emphasized that systematic reforms in revenue collection and efficient financial governance are essential for achieving inclusive and sustainable economic growth in Karnataka.