Experts say sovereign, pension fund investments bring long-term capital, aiding economic growth and job creation

New Delhi

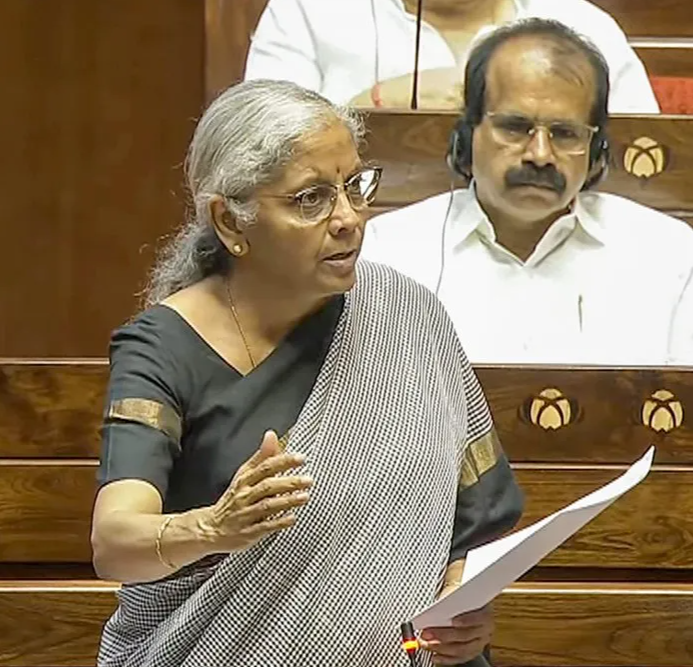

India continued to attract steady foreign investments in FY25, with sovereign wealth funds (SWFs) investing a net Rs 8,426 crore, Finance Minister Nirmala Sitharaman told Parliament on Monday. The inflows underline long-term investors’ confidence in India’s growth path.

While the figure is lower compared to Rs 47,604 crore in FY24, and Rs 15,446 crore in FY23, it still highlights India’s resilience. The only exception in recent years came in FY22, when sovereign wealth funds pulled out Rs 3,825 crore.

Between FY22 and FY25, financial services emerged as the top sector, receiving Rs 28,562 crore, followed by IT at Rs 19,135 crore. Healthcare attracted Rs 7,830 crore, while telecom saw Rs 7,053 crore in inflows. These sectors reflect India’s strengths in digital technology, innovation, and growing healthcare services.

Experts believe such investments are crucial because sovereign and pension funds usually bring patient, long-term capital that helps boost economic development and job creation. They also show global faith in India as one of the most promising emerging markets.

The Finance Minister noted that while foreign direct investment (FDI) inflows from sovereign wealth and pension funds are not tracked separately, their portfolio investments are closely monitored across sectors.

To attract more such inflows, the government has introduced tax exemptions, eased rules, and raised foreign ownership limits. Sitharaman highlighted that over 95 percent of FDI now comes through the automatic route. The Union Budget 2025 also increased the FDI cap in insurance to 100 percent, up from 74 percent, further signaling India’s openness to foreign capital.