The Goods and Services Tax (GST) has been a transformative tax reform in India since its implementation in 2017, unifying various indirect taxes under one umbrella with the vision of simplifying compliance and boosting economic growth. However, over the years, India’s GST evolved into a complex system with four different tax slabs—5%, 12%, 18%, and 28%—applied to myriad goods and services. While this tiered structure aimed to tax products based on their essentiality and luxury status, it introduced challenges like classification disputes, compliance complexities, and inverted duty structures that impeded smooth functioning for businesses and consumers alike.

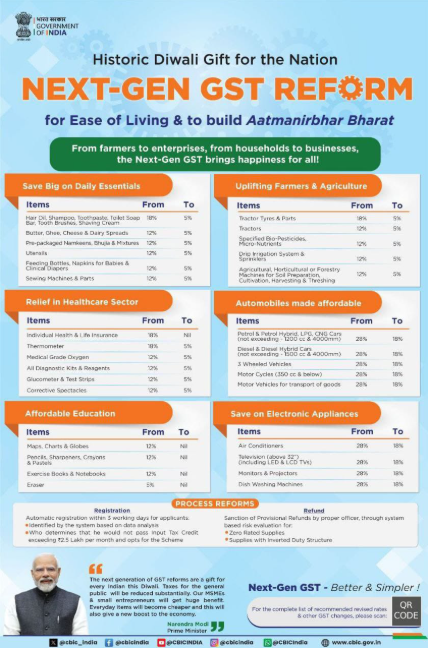

Recognizing these issues, the government introduced sweeping GST reforms, effective from September 22, 2025. The reforms significantly rationalize the GST slab system by consolidating the rates, easing compliance burdens, and fostering an environment conducive to business growth and economic inclusiveness. This article delves into the details of this new tax regime, the reasons behind the overhaul, and its expected impact on the Indian economy.

The Old vs. New GST Rate Structure

Prior to the reform, the GST slabs were as follows:

- 5% slab: Basic essentials, household goods, and unbranded items

- 12% slab: Processed foods and consumer durables with moderate consumption

- 18% slab: Most goods and services, including telecom and automobiles

- 28% slab: Luxury goods, sin products, and certain high-end services

However, such a system caused several operational problems. For instance, certain goods attracted higher taxes on inputs than on finished products, causing inverted duty structures. Additionally, narrow gaps between slabs and ambiguous product classifications led to disputes, delayed refunds, and increased litigation. This complexity also created hurdles for small and medium enterprises (SMEs) that form the backbone of the Indian economy.

The 2025 reforms seek to address these issues by simplifying the GST framework into two primary slabs along with a special rate:

- 5% Merit Rate: This includes essential commodities, daily consumables, agricultural and healthcare products, and other critical necessities. The intent is to keep everyday items affordable for all citizens.

- 18% Standard Rate: Covering most other goods and services, this rate applies to the broad middle spectrum of consumption. It helps maintain revenue without overly burdening the consumer.

- 40% Special Demerit Rate: The government has also maintained a higher tax rate for sin and luxury goods like tobacco products, pan masala, and luxury automobiles. This ensures fiscal prudence while discouraging harmful consumption.

This consolidation from four slabs to mainly two clearly defined rates resolves most classification ambiguities and paves the way for easier compliance.

Why Was Simplification Needed?

The Indian economy is one of the fastest growing in the world, with increasing consumer demand and expanding MSME sectors. Businesses demanded a tax framework which was:

- Simpler to comply with: Multiple rates meant complex invoicing and frequent disputes. The simplification makes it easier for tax officers and taxpayers to operate efficiently.

- Reduces inverted duty burden: Many businesses found that the tax on inputs was sometimes higher than on outputs, locking their working capital. The new regime fixes this mismatch by rationalizing rates.

- Enhances dispute resolution: Clear slab distinctions minimize litigation and speed up GST refund cycles, improving cash flow for businesses.

- Supports digital adoption: The simplified system synchronizes well with ongoing efforts towards automated GST return filings with minimal human intervention.

Sectoral Impact

The effect of this rationalization will be felt across the economy. For example, automobiles previously taxed at 28% will face an 18% tax rate, lowering consumer prices and spurring demand. Similarly, consumer electronics and telecom services become more affordable, benefiting end consumers and manufacturers alike.

The FMCG sector will see essential packaged foods remain under the 5% rate, ensuring that inflationary pressures on ordinary citizens ease. Service providers to small businesses and informal sectors will benefit from lesser compliance hassles and better liquidity, which is crucial for boosting employment and production.

Transition and Compliance

The government has planned a smooth transition with timelines and guidelines to help taxpayers migrate seamlessly to the new slabs. Training programs and updated GST software tools accompany the rollout, aiming for minimal disruptions.

To address the fiscal concerns of states, especially around compensation cess collections, the government has deferred some tax hikes on tobacco and related sin goods to balance state revenues.

Furthermore, the government is enabling quicker dispute resolution through the establishment of the GST Appellate Tribunal by the end of 2025. This will help finalize tax disputes swiftly, allowing businesses to focus on growth.

Towards a More Citizen-Friendly GST

Ultimately, this reform marks a milestone in making India’s GST “simple, transparent and fair.” By rationalizing tax rates, the government aims not only to ease doing business but also to enhance consumer welfare by lowering tax burdens on essential goods and services.

This approach encourages voluntary compliance, supports farmer incomes, strengthens MSMEs, and accelerates India’s growth trajectory. For citizens, a clear and simpler GST system means lower prices on essentials and less time spent on tax procedures.

As India rationalizes GST rates into simpler slabs, the government has also introduced a significant exemption under this new framework — the complete removal of GST on individual life and health insurance policies. This highlights a crucial step towards making insurance products more affordable and accessible for the common man. The aim is to boost financial security at the grassroots, ensuring families, especially vulnerable sections like the elderly and those with health risks, have better coverage.