New York

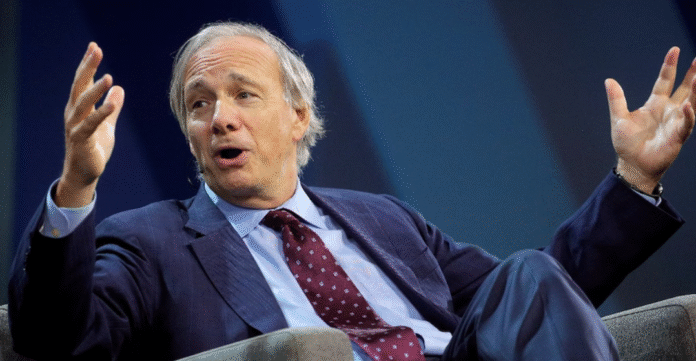

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has issued a stark warning: the US stock market could be headed for a heart attack. His analogy points to record-high equity valuations and ballooning US debt that risks crowding out future spending—similar to how plaque clogs arteries.

Dalio cited record-high equity valuations and mounting US government debt as key factors contributing to potential instability. He stated that as the US spends more to service its debt, it squeezes out other spending, drawing a parallel to plaque accumulation in a human circulatory system. Dalio’s comments, delivered at an Abu Dhabi Finance Week event, come as geopolitical tensions escalate and economic uncertainties persist.

Dalio’s prescription for investors? Rebalance portfolios and allocate 10–15% to gold. He argues that gold is a time-tested store of value, offering diversification and protection when traditional assets stumble. A well-diversified portfolio would have somewhere between 10% and 15% in gold, he noted, emphasising its role as a crisis hedge.

Dalio argued that gold’s lack of correlation with other asset classes makes it especially valuable when markets are volatile, as its price tends to rise when other investments falter. This strategic allocation is intended to help preserve wealth amid uncertain economic conditions.

The advice comes as US markets remain buoyant, with the S&P 500 and Nasdaq up double digits this year. Yet Dalio warns that investors must look past short-term rallies and ask, whose money do you own? a reminder to assess risks carefully in a debt-laden economy.