Steady Amid Storms

New Delhi

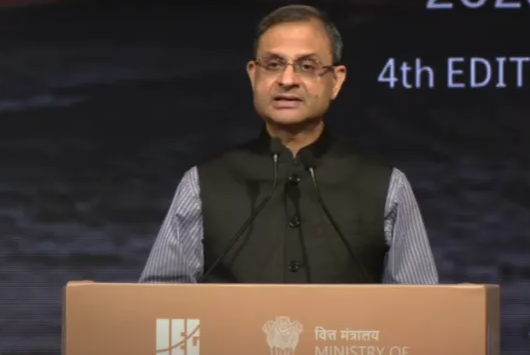

Reserve Bank of India Governor Sanjay Malhotra said on Friday that India has emerged as a rare anchor of stability in today’s uncertain world, despite global trade tensions and geopolitical shocks. Speaking at the fourth Kautilya Economic Conclave, he credited policy continuity, institutional strength, and reform momentum for helping India avoid major financial crises.

Malhotra noted that India remains one of the fastest-growing large economies, with inflation expected to return to the RBI’s 4 percent target by February 2025. He contrasted India’s resilience with the struggles of advanced economies dealing with tariff turmoil and other uncertainties.

“India’s fundamentals are strong, with low inflation, healthy foreign exchange reserves, a narrow current account deficit, and robust balance sheets for banks and corporates,” he said. Malhotra praised the joint efforts of policymakers, regulators, and financial institutions in maintaining stability.

Reflecting on global central banking, he pointed out that in the past two decades, central banks shifted roles from being steady guardians of price stability to emergency responders. They faced crises ranging from the 2008 financial meltdown to the eurozone debt issue, Covid-19, the Ukraine war, and climate disruptions. “You cannot control the storm, but you can steer the ship,” he remarked.

For India, steering meant aggressive monetary easing during the pandemic, liquidity support with clear exit strategies, and a rapid tightening cycle when inflation rose above limits in 2022.

Looking ahead, Malhotra warned that the global economy may underperform due to high tariffs, rising public debt, and complacent markets. He added that gold prices are increasingly acting like oil once did—as a key barometer of global uncertainty.