The President urged banks to empower farmers and rural areas through timely credit, financial literacy, and agri-tech support, while also strengthening MSMEs, which she described as vital engines of economic growth

Chennai

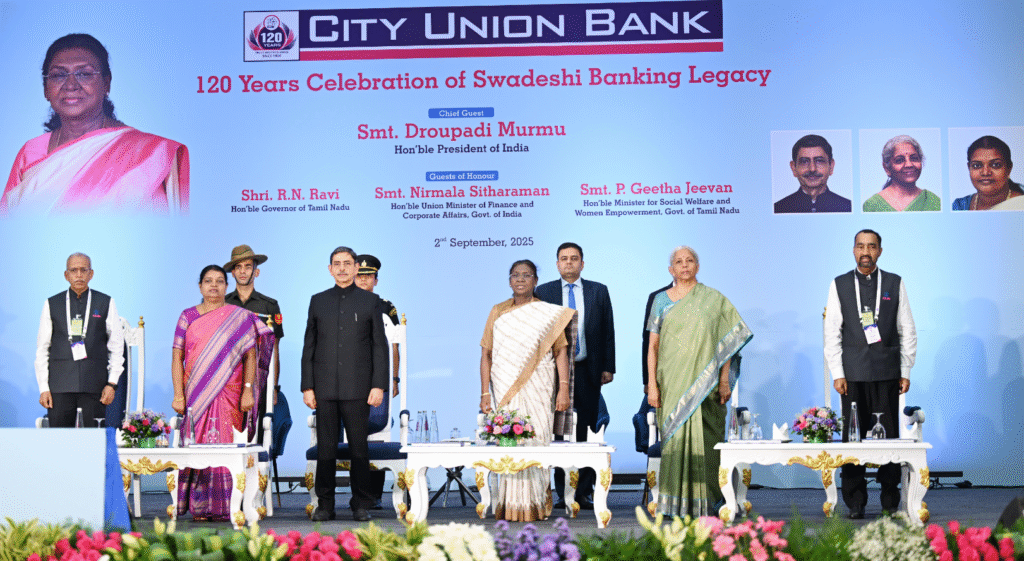

President Droupadi Murmu on Tuesday stressed the need for banks to play a stronger role in achieving complete financial inclusion, calling it a key pillar of India’s development. Speaking at the 120th foundation day of City Union Bank, she said banks must ensure that every citizen has access to affordable financial services, especially in rural and semi-urban areas.

She noted that India’s economy is among the fastest-growing in the world, and banks today are not just custodians of wealth but also providers of diverse financial solutions. Murmu appreciated City Union Bank’s efforts in financial inclusion and highlighted the role of fintech, mobile apps, microloans, and digital wallets in reaching underserved communities. However, she pointed out that challenges such as digital literacy, poor internet access, and lack of awareness continue to limit progress.

The President urged banks to prioritize the empowerment of farmers and the rural economy by offering timely credit, financial literacy, and support for agri-tech innovations. She also emphasized the importance of strengthening micro, small, and medium enterprises (MSMEs), calling them engines of economic growth.

Murmu further said that banks should extend special support to marginalized groups, including daily wage earners and migrant workers, to bring them fully into the banking system. She underlined that as India’s economy becomes more digital and knowledge-driven, banks will play a vital role in entrepreneurship, start-ups, and smart city projects. By embracing digital transformation and inclusive practices, she added, banks can become active partners in building a developed India.